You’ve done your research. You know about the environmental and financial benefits of solar power, and you want to make it a priority in your life—but you’re still unsettled about the cost of installing a solar panel system. Sound familiar? Here’s some great news to put your mind at ease. There are ways to reduce how much money you need to invest in a home solar panel system all at once. In some cases, with a solar lease, rather than a purchase, you can even get solar panels without paying for anything up front. Your monthly payments will simply replace the cost of your monthly electric utility bills when you lease solar panels.

How Can Homeowners Get Affordable Solar Panels?

There are two main ways homeowners can get affordable solar panels—by signing a solar panel lease, or pursuing a Power Purchase Agreements (PPA). The primary differences between them are:

- Lease: You pay to lease the solar equipment or for the power produced

- PPA: You ultimately have the option to purchase your solar panel system

Of course, nothing in life is completely free. With a solar lease agreement or PPA, the cost of the solar panels is figured into your monthly bill and spread out over time. But this makes the overall payment much more convenient.

Overall, both of these approaches offer some very appealing ways to save. Let’s take a look at the two choices to see why you may be interested in a solar lease or PPA.

Solar Panel Leasing

How Does A Solar Panel Lease Work?

A solar lease agreement is a hands-off, manageable way for homeowners to get solar panels. Essentially, a you lend a solar service provider your roof, and they lend you the equipment to generate clean, renewable energy. Here’s how it works.

- You enter an agreement with a solar company that installs and maintains your system, often for $0 down. Then, you make fixed monthly payments to lease your solar system from that company — very similar to how you finance a car. Conveniently, these payments are usually about the same as your former monthly electricity bills, so you may not even notice much of a difference.

- During your lease duration, you may notice that your monthly lease payments increase over time. This is usually to account for future increases in the price of energy. However, your provider will likely cap the allowable increase, usually somewhere around 3%. So even while utility rates continue to rise, yours may level off, which means you will save money. But be sure to take a good look at the terms. Ask the solar provider to clarify any terms that you are confused about.

- A local solar energy company will handle the installation and maintenance of your solar panels. They may even offer additional warranties, insurance, and complimentary repairs. Again, take a close look at the terms. In some cases, you remain responsible for replacement of failing equipment.

Solar Leasing Contracts

When entering a solar panel lease agreement, it’s important to read the terms carefully before signing. Here are some specific contract terms and options to consider when leasing:

Down payment

Is there a payment due when you sign the contract? At installation? At inspection? Most companies require zero down when leasing.

First monthly payment

What is the initial monthly payment? Some lease agreements offer the option to pre-pay some of your electricity in order to lower your monthly payments, much like you would when financing a car.

Rate increase cap

Electricity prices tend to rise about 2%-5% each year. So the monthly amount you pay your solar company to provide your power may also increase slightly year to year. However, your lease agreement will include a cap on this increase. This way, your monthly payments never increase by more than a set percentage — usually about 1%-5% percent.

How long is the lease term?

Traditional solar leases are usually 20-30 years, about the life-span of your solar panels.

What happens at the end of the contract?

At the end of your initial lease term, your options may include renewing the solar lease contract for one to ten years, upgrading to a newer solar panel system and signing a new contract, or removing the system.

Can I purchase my solar panels?

No, a typical solar panel lease does not include the option to buy at the end of the contract term. If you think you will want to buy the panels eventually, explore a PPA instead.

What happens if I move?

If you decide to move, your options may include transferring the lease and payments to the buyer of your home, moving the solar panel system to your new home, or paying to remove the solar panels from your roof.

Pros and Cons of Leasing Solar Panels

Advantages

By leasing solar panels, you replace your monthly utility bill with a monthly equipment lease payment and pay no cash up front. You enjoy low (or no) installation and maintenance costs. You may also benefit from solar panels in other utility costs by home heating through solar power, solar pool heating, and even solar hot water heater installation.

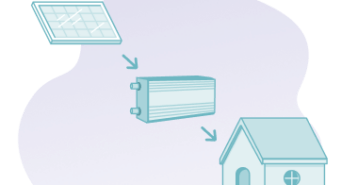

When installing your new solar energy system you may also have the added benefit of deciding what type of solar panels are installed, different style options for mounting new solar panels, and even the solar inverter installed on your home.

Disadvantages

When you lease, you usually don’t have an option to eventually buy. Also, by leasing, you forfeit the ability to gain price advantage by selling electricity with solar net metering (in other words, selling any power you use back to your local utility company).

A word of caution: Before you start searching for a solar installer, make sure leases are available where you live, because they may not be available in less sunny states. We recommend doing some research on your Solar Sun Number Score for your home before leasing.

Power Purchase Agreements (PPAs)

How Does a Power Purchase Agreement (PPA) Work?

Another way to finance your solar panel system is through a PPA. With this option, you purchase the electricity that your system generates—instead of the system itself—at a reduced rate over a fixed period of time. Your payments are determined per kilowatt hour (kWh) of energy used. You’ll also have the option to purchase the solar system at predetermined times throughout the lease term.

Similar to a traditional solar panel lease, the benefit of a PPA is that the solar company that installs and maintains your system handles most—or all—of the upfront costs and logistics. They will also bear the risks associated with the system’s operation and performance. In addition, the cost you pay for your electricity will be set at a low rate, determined in one of two ways:

- A fixed escalator plan: Your electricity prices rise at a predetermined rate between 2%-5% percent. This is often lower than the increased prices you would otherwise pay your utility company.

- A fixed price plan: The price you pay remains constant throughout the loan term. As utility prices rise over time, your prices won’t budge, which makes for easy household budgeting.

Unlike a traditional solar lease, with a PPA you have the option to buy your energy system from the developer. The downside of the PPA is that it’s bit more complicated than a lease. Since only about half of U.S. states allow PPAs, first make sure your state is one of them. You can check this map.

Contract Terms to Consider with a PPA

How much will my energy cost?

The cost of electricity will be a fixed, predictable, low rate. It will not increase beyond a predetermined rate — usually 2%-5%.

How long is the lease term?

About 10-25 years. The solar developer is responsible for operation and maintenance of the system during that time.

What are my options to buy?

At certain points within your PPA —for example, at five years or at the end of the lease—the homeowner can decide to buy the solar panel system. As the owner of a residential solar panel system, you may then be eligible for additional rebates and tax incentives.

Summary: Solar Leasing vs. PPA

So with a PPA, you make low, fixed-rate monthly payments based on the kWh of energy used. You also have the added option to buy your system from the solar developer.

With both solar leases and PPAs, homeowners can dodge many of the logistical barriers associated with solar installations. These include high up-front costs, financing and design, permitting, maintenance, and monitoring. All you provide is your property and a commitment to make fixed monthly payments—and the service provider handles the rest.

Also called “third-party ownership,” these two options—not surprisingly—are very popular. In fact, 60% of U.S. homeowners with solar have used third-party ownership.

Solar leases and PPAs make it possible for homeowners to go solar with little or no money down. Plus, your monthly payment ideally is no more than what you’re currently paying your utility for electricity. So the potential for future savings is significant—especially since it starts just as soon as you flip the switch.

Compare top-rated solar pros in your area.

Read real homeowner reviews, explore qualifications, and view promotions. Modernize makes it easy to browse professionals and find one that will be perfect for your project.