What are the selling points you can offer homeowners to help them overcome common concerns about home improvement projects? As a solar installation contractor, you know that these services will positively impact the home.

The key is to help homeowners with their questions and concerns, so they are ready to move forward with the installation. Through this process, you are more than a provider – you are acting as a guide to help each person navigate the industry.

One crucial step is to help homeowners maximize their spending by tapping into available solar rebates and tax credits.

Cost of Solar: Prices are Dropping

Not only has the price of solar equipment and installation decreased by an estimated 70% in the last 10 years, but homeowners can also reduce their out-of-pocket expenses through solar rebates. Showing families information about the affordability of solar power is a necessary step to close the deal.

Many people mistakenly assume they can’t afford solar installation when the truth is that solar is much more accessible than they might think. There are great solar rebates that can offset the overall cost of a residential or commercial solar power system. As a solar installation provider, use these rebates to help homeowners find the best ways to save money.

Enhanced Solar Tax Breaks for Homeowners

In December 2020, Congress signed into law a change in tax breaks for solar installation. The original solar tax credit plan was going to start phasing down at the end of 2020. Now, the timeframe is extended to continue the 26% solar tax credit through 2022, instead of dropping it to 22% in 2021 as initially planned.

These tax credits have supported the solar industry’s growth and are essential in making solar installation affordable for the average family. Families can use the credit on their income taxes the year following their solar installation.

Additionally, there are many state and local solar incentives across the country. You can check your local area in the Database of State Incentives for Renewables & Efficiency. Familiarizing yourself with your state’s incentives and policies empowers you in guiding potential customers in choosing the right solar products to meet their unique needs.

Sharing Solar Rebate Information with Homeowners

If cost is a homeowner’s most significant concern in moving forward with a solar installation, then you can close more deals by sharing information about solar rebates. These tax credits can save thousands of dollars on the installation, giving you a good selling point to overcome common homeowner concerns.

Here are a few tips to share solar rebate information with potential customers:

- Current Leads: Look for ways to include solar rebate resources in every conversation with current leads.

- Remarketing: Distribute an update to older leads through an email newsletter, postcard, or reach out for a phone conversation.

- Website: Add a section on the homepage of your website highlighting the extended tax credits.

The goal is to communicate the solar rebates so homeowners can catch the vision of saving thousands of dollars on their installation. This talking point will increase the likelihood that potential customers will choose to move forward with their residential solar investment.

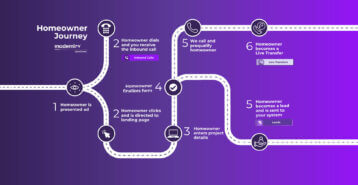

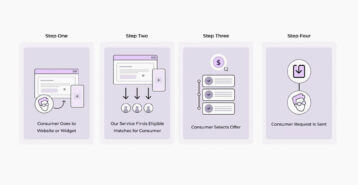

At Modernize, we make it easy for contractors to connect with vetted homeowners looking for services. If you’re looking for more leads in your solar installation business, then we are here to help. Reach out to learn more about how our proven systems help home contractors find homeowners who are ready to buy.