Empowering Home Services Professionals From Inquiry to Install

Scale your business with Modernize’s multi-product platform supporting the home improvement and services industries guiding the customer journey. Helping providers grow through stronger marketing, smarter lead flow, and flexible financing.

Fueling Growth for 800+ Home Service Businesses Nationwide

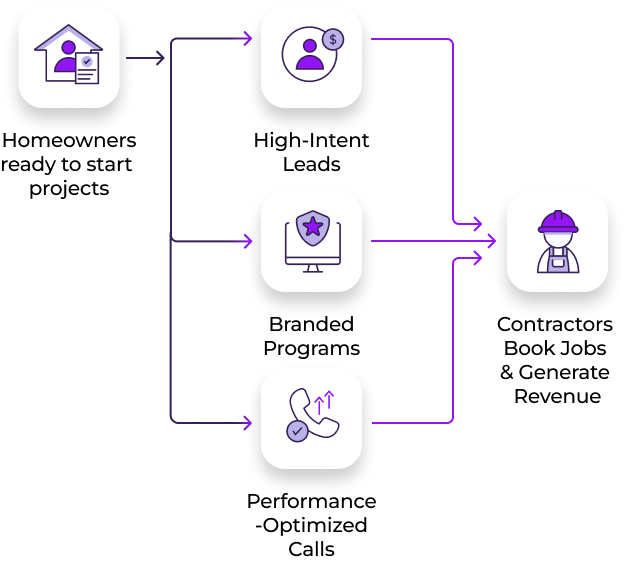

Modernize is the data-driven lead generation partner for home improvement professionals. We connect contractors with homeowners who are actively planning and ready to start projects. Through high-intent leads, branded programs, and performance-optimized calls, we help you reach serious buyers at the moment they are ready to move forward. Every channel is designed to drive trust, boost conversions, and accelerate revenue growth.

We Provide Solutions Across 20+ Different Trades

We are selective about the trades we work with and are constantly adding new ones to support the community.

360Finance is our next-level financing solution built for home improvement and services professionals. We give sales teams a seamless way to offer transparent, homeowner-ready financing at the point of sale. By partnering with trusted lenders, contractors can present multiple offers from a single inquiry that helps homeowners say yes to bigger projects without the burden of upfront costs or high-interest credit. It’s a proven game changer for closing more jobs, faster.

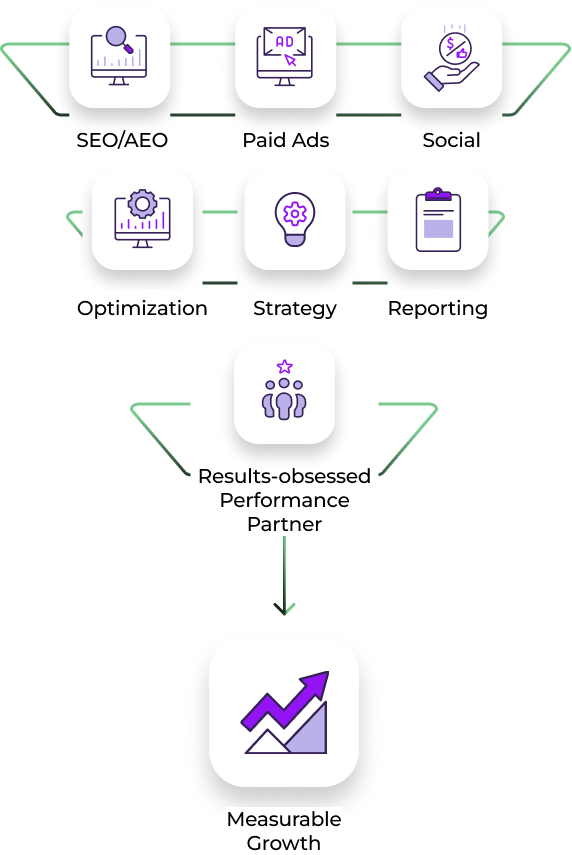

Our Marketing Products is your dedicated growth engine: a full-funnel, performance marketing partner built for home service businesses. We blend cross-channel strategy, expert execution, and deep industry insight to lower acquisition costs and boost ROI. Our services span Answer Engine Optimization, SEO, Programmatic Ads, Paid and Organic Social Media and analytics all backed by full data visibility and a platform built to optimize performance. With a results-obsessed team rooted in home services, we turn complexity into clarity, and marketing into measurable growth.

Customer Case Studies

How Modernize Drove a 200% Revenue Increase for Bath Planet

California Deluxe Maintains 20-30% Conversion Rates with Modernize

How Modernize Helped ARS

2025 by the numbers

Homeowner Inquiries

Leads Delivered

States Covered

Partner Revenue Generated