How to Find and Apply for Solar Panel Rebates

Many homeowners switch to solar to save on energy costs, but the upfront price can feel steep. The good news? There are several ways to offset those initial expenses. From federal tax credits to state and local solar panel rebates, you have options to make your system more affordable. Wondering how to find and claim these savings? Let’s break down the different types of solar panel rebates and credits available to help you get started.

Federal, State, and Local Solar Panel Rebates

Your solar panel rebate options depend on where you live. Even if your state doesn’t offer rebates, you could still qualify for federal tax credits. When exploring your savings options, focus on three levels: federal, state, and local. Each level may offer different programs to help make your solar investment more affordable.

How Does the Federal Solar Tax Credit Work?

Also called the Residential Clean Energy Credit, the federal tax credit allows homeowners to claim 30% of their solar expenses on their taxes — at least until 2032. This credit applies to more than solar panels, though. You can use federal tax credits for solar batteries and water heaters, geothermal heat pumps, wind turbines, and more.

The credit will cut the cost of installing a home’s solar rooftop system by 30 percent for the average system. The installation of the system has to be completed during the tax year.

The federal tax credit applies to the cost of your solar system and all its components. There’s no limit to the amount you can claim (except when claiming the rebate for fuel cells), so you can claim future credits when you make additional energy-efficient upgrades up until the program ends. You’ll need to file the Residential Energy Credits form when filing your taxes to claim this credit. The rebate goes toward future tax payments.

Remember, you must own your solar panel system to claim the credit. Renters and rental properties are not eligible. See our article for a full breakdown of how the Residential Clean Energy Credit works.

State Solar Rebates and Incentives

State incentives are a little trickier. They vary by state and sometimes even within the state itself depending on the utility company provider. Rebate amounts also change often. To get the most updated information about if your state offers a solar rebate and what it entails, we recommend visiting the Database of State Incentives for Renewable Energy, also known as DSIRE.

Operated by the North Carolina Clean Energy Technology Center and funded by the U.S. Department of Energy, DSIRE provides an extensive, searchable summary of renewable energy and energy efficiency incentives. To use DSIRE to find solar rebates and incentives, you should…

- Click on your state.

- Filter results to explore and zero-in on financial incentives like solar rebates and personal tax exemptions.

- Use the “Technology” and “Renewable Energy” filters to find offers related to solar technology.

City- or Region-Specific Solar Incentives

It’s best to work with an experienced solar installer who will be familiar with the incentives in your state and region, as well as the process and paperwork required to get them. Identifying city-specific solar rebates and incentives involves a bit of legwork. In addition to DSIRE, here are a few people/places you can check in with to get started:

- Your city or county’s website

- Your current utility company

- Neighbors with solar panels or your neighborhood HOA

Ask your solar professional to assist you in identifying and applying for rebates and incentives. Many will even take care of all this paperwork as part of their service package.

One final note: Tax credits and solar rebates are often directed to the owner of the residential solar system. So, if you’re leasing your panels, you can expect the professional contractor to file and collect these incentives.

What Are the Current Solar Panel Rebate Incentives?

Financial incentives for residential solar installation projects vary greatly depending on the state where your property is located and the year in which your panels are installed. Here is an overview of the general types of incentives available to U.S. homeowners.

The Residential Clean Energy Credit

This credit allows homeowners to deduct 30 percent of solar costs off of federal taxes, from now through 2032.

Solar Loan Programs

These loan programs are offered at the federal and state level to purchase solar panel systems and equipment. State programs, for example, may offer a low- or zero-interest rate, typically for a term of ten years or less.

Personal Solar Tax Incentives

Incentives such as tax credits and deductions reduce the upfront cost of purchasing and installing a residential solar panel system if you decide to buy. Eligibility requirements, such as which types of equipment qualify for the credit and the maximum amount you can deduct, vary by state.

Property Solar Tax Incentives

Adding a solar panel system to your property may increase the value of your home, which could mean higher property taxes. Solar property tax incentives exclude or reduce this added value for taxation purposes.

This incentive keeps you from being penalized for adding renewable energy systems to your house.

Solar Rebate Programs

As outlined above, rebate programs for solar panels are available from states, local governments, and utilities in varying amounts. For example, your state may offer a cash incentive when you install qualified equipment like solar panels.

Your local utility company may also offer you a credit if your grid-connected system produces more energy than you use. You can actually sell that extra energy back to the grid. This is called net metering or net excess generation (NEG).

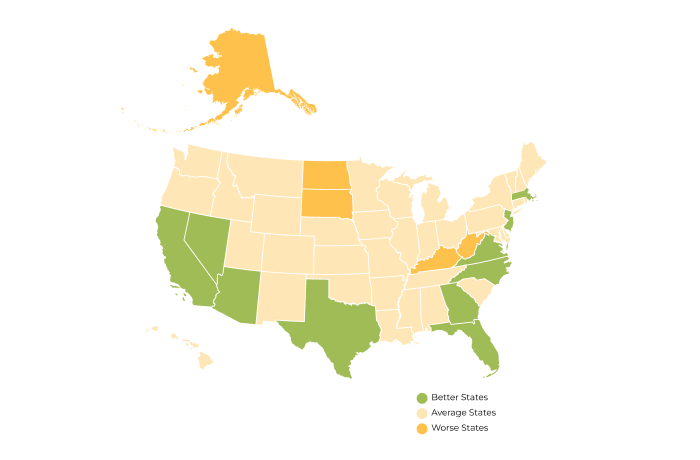

Which States Have the Best Solar Rebates and Incentives?

Using DSIRE.org, we have collected some examples of tax credits and solar rebate programs offered at the state and local levels from prime states where sunshine is plentiful and local governments are focused on promoting renewable energy.

California Solar Incentives

California Solar Initiative (CSI) offers a rebate for excess energy generated by a residential solar panel system. The amount is based on either the expected or actual output of the system. It is distributed as either a one-time payment or in monthly installments.

Texas Solar Incentives

The SMART Source Solar PV Rebate Program offers rebates to any customer for home photovoltaic (PV) systems at a flat rate of $1.05 per watt (W)-DC for residential customers. Solar panel installation in Austin, TX has skyrocketed over the years and increased Texas home value in highly desired real estate areas.

Florida Solar Incentives

To date, no statewide rebates for solar panels exist in Florida. Still, there are different factors — like the state’s sales tax exemption — that may help save residents some money.

Florida also allows for net metering, meaning solar energy generated by homeowners can be sold back to their utility company for credit. Net metering incentives are in place now, but are anticipated to be phased out within the next seven years.

The state also has a solar property tax exemption incentive that is running through 2037. Certain regions within Florida offer additional rebate and loan programs. It’s important to check with a local contractor who is knowledgeable about local deals.

Arizona Solar Incentives

Rebate programs for solar energy are available across most of Arizona, including the Renewable Energy Production Tax Credit. Local incentives include an exemption from sales taxes for solar equipment. The perks range from city-to-city. In Phoenix, for example, the city participates in a clean energy coalition dedicated toward energy efficiency.

North Carolina Solar Incentives

North Carolina offers a number of incentives for homeowners to install solar panels. State legislation implemented a low-interest loan program for energy upgrades. The state also made homes with solar panel installations exempt from increased property taxes. Rebates offered by local electric companies throughout the state range.

New Jersey Solar Incentives

The Garden State offers a number of solar energy programs and perks, including net metering programs and solar incentive programs where residents can earn money depending on how much energy their homes produce. New Jersey also offers a sales tax exemption for home solar systems as well as a property tax exemption for renewable energy systems.

Massachusetts Solar Incentives

Massachusetts homeowners can take advantage of the Residential Renewable Energy Income Tax Credit, which is worth up to 15% of their system’s cost and caps at $1,000. Additionally, the state offers homeowners credit for producing energy, which varies by region and provider. State sales tax and property tax exemptions are both in place. The savings may also extend depending on the city.

Utah Solar Incentives

In Utah, there is a state solar tax credit for 25% of a homeowner’s solar system costs with a cap of $800. The maximum amount is expected to decrease in 2023 and the credit will expire in 2024. Other incentives — including net metering and solar battery incentive programs — vary by area.

New York Solar Incentives

New York offers a residential solar sales tax credit for 25% and various regional programs. The NY-Sun Megawatt Block Program, for instance, allows up to $1,000 for every kilowatt of solar power installed. Incentives and programs vary by region.

Nevada Solar Incentives

In addition to the federal tax credit, the state of Nevada offers homeowners a residential energy storage incentive. The Nevada Residential Energy Storage Incentives offers homeowners savings when they add a new home battery to their rooftop solar panel system.

Many states, and certainly the federal government, are encouraging solar energy. They want you to give it a try and are willing to help you pay for it. So don’t let the initial sticker price deter you from solar.

Compare top-rated solar pros in your area.

Read real homeowner reviews, explore qualifications, and view promotions. Modernize makes it easy to browse professionals and find one that will be perfect for your project.