When homeowners are on-the-fence about investing in roofing upgrades, a good rebate or tax credit might be the ticket to close the deal. As a roofing contractor, are you familiar with federal and state incentives available for residential roofing installation?

How Roofing Upgrades Can Qualify for Federal Tax Incentives

The federal government is offering tax credits for homeowners who choose to make their homes more energy–efficient by installing alternative energy equipment. For example, certain roofing products are eligible for tax credits if they meet Energy Star requirements.

Roofing materials that fall in the category of “cool roofs,” such as asphalt shingles and metal roofs, reflect part of the sun’s energy away from the house. Reducing the heat transfer helps to decrease the HVAC energy required to maintain a comfortable climate inside. It’s a win-win: homeowners save money on utilities and are less dependent on the energy grid.

Another big focus is on the installation of solar panels, which also affects the roofing industry. According to the IRS website, structural components and traditional roofing materials don’t qualify for these federal tax credits. But certain solar roofing shingles and tiles can perform the function of conventional roofing while also serving as electric collectors. Since these components work for structural support and solar energy generation, they may qualify for the tax credit.

Show Potential Customers the Investment in Roofing Services

A home is likely the biggest purchase someone will make in their lifetime. This investment can build long-term equity and result in financial benefits in the future. Roofing contractors have an easier time closing the deal when helping homeowners understand the investment opportunities in their homes.

Aesthetic home renovations, such as kitchen or bathroom remodels, can wait. But structural repairs, like a roof replacement, is a time-bound investment. Postponing these repairs could negatively impact the value of the home.

As you are talking to current or older leads, here are a few key steps you can take to educate your potential customers:

- Available Tax Credits: Educate yourself about available incentives and roofing rebates for energy efficiency upgrades. For example, check out the Database of State Incentives for Renewables & Efficiency website to look for information specific to your local area.

- Share Roofing Rebate Information: Be proactive in helping each person tap into available federal and state tax credits and rebates to reduce their out-of-pocket costs.

- Website Updates: Include incentive and rebate information on your website for potential customers to read.

- Protecting Home Value: Look for ways to show each homeowner how investing in their roof can protect the value of their real estate holdings.

Keep in mind that certain tax credits for residential energy efficiency have been extended through 2021 and 2022. Start the conversation with potential leads right now so they can complete the installation and maximize their savings while these tax credits are still available.

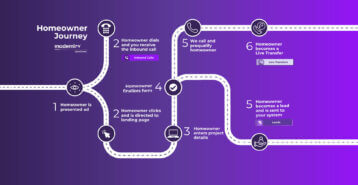

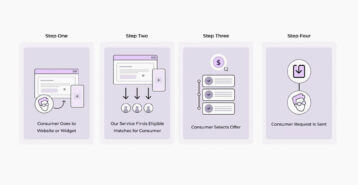

Streamlined Solutions for Finding Roofing Leads

At Modernize, we have a streamlined system to connect roofing contractors with customers who are looking for local services. If you want to help more families take advantage of available roofing tax credits, tap into the resources that we offer for lead generation.