COVID-19 news and updates change quickly and frequently. Some of the information in this article may soon be out of date. We will do our best to keep details updated during this challenging time. The article below reflects information as of April 16, 2020.

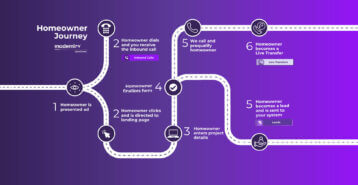

As we adjust to sheltering in place, many businesses are thinking about what will happen next. As other countries begin to stabilize, like China and Italy, we can see a preview of how our economy will rebound from this pandemic. Now, more than ever, contractors need to focus on managing cash flow to sustain their business, as we get closer to ending social distancing.

Here are a few considerations for your business for the current and post-COVID-19 world:

Review your credit policy.

If you have a credit policy, now is an excellent time to review your current policy. And if you do not have one, now it is the time to create one.

Most of Modernize’s trades —roofing, HVAC, windows, and solar— are considered credit-heavy. Evaluate the different factors within your credit policy, including your minimum credit acceptance rates, early payment incentives, and financial partners. Now is a good time to review the financial partners you recommend to homeowners.

Review your accounts receivable aging report to identify opportunities where you control more cash. Depending on your aging time, you may potentially change your payment plan policies— and collect more frequently. For example, a homeowner undergoing a window replacement project may pay in five increments of $5,000, instead of one payment of $25,000. This is a favorable payment system for both you, and your customer.

Change your payment policies to better manage cash flow.

Changing your payment policies to complement your credit policy helps create a better process for your sales and accounting teams. Consider invoicing at different stages of a project, including demolition, material orders, installation, and final inspection. In addition to increasing cash flow, you will likely create deeper trust with your customers. The homeowner will feel in control of the payment schedule, and you will be able to receive cash more quickly.

Next, create a simple forecast based on how projects will close and when each payment is expected. Within a spreadsheet, fill out rows that share the number of jobs in each phase. In the columns, note the months (or weeks or days) you would expect the cash to arrive. This will help you understand the impact of cash immediately by changing your policy.

Be sure to consult your team before making these changes. Keep current customers in mind when communicating the new policy. Ask them on their preference, as they most likely agreed to the previous terms. Have the homeowner agree —in writing— to any changes.

Align with your sales team.

After making updates to your credit policy and payment policy, be sure to notify your sales and finance teams of these changes. One of the most important steps will be to make sure these changes are reflected across your entire business.

When communicating with all your teams, be transparent about the changes and your objectives. Ensure your sales team understands that while more revenue is good, having cash in the bank is critical.

Make sure your credit and payment policy documents are updated and include your objectives. Share these documents with your finance team. Arrange meetings with both teams to discuss potential impact through a small risk analysis. This exercise is a simple, effective way to make sure everyone understands the changes proposed.

Cash flow management can be difficult even during “normal” business. Now, in uncertain times, it will take both diligence and flexibility to ensure your business continues to operate smoothly. Creating a plan today will benefit your company and team, as well as prepare you to assist more homeowners in the weeks after COVID-19.