At Modernize, we know that understanding homeowners is the key to helping contractors succeed. Since 2018, we’ve conducted our annual Homeowner Insights Survey, gathering feedback from hundreds of thousands of homeowners across key trades like windows, roofing, HVAC, and more.

This year, more than 14,000 homeowners shared their perspectives on budgeting and financing, giving us fresh insights into the challenges and priorities shaping today’s home improvement market.

Homeowners Are Feeling Financial Pressure

For today’s homeowners, the biggest obstacle to completing home improvement projects isn’t vision, it’s the financial strain that comes with making them a reality. More than half of homeowners surveyed (52.68%) describe themselves as struggling financially, compared to only 7.66% who feel comfortable. This imbalance shows just how widespread economic stress has become.

The reality is that many homeowners are balancing the need for critical home improvements with tight household budgets. For contractors, this means cost is not just a factor, it’s often the deciding factor in whether a project moves forward.

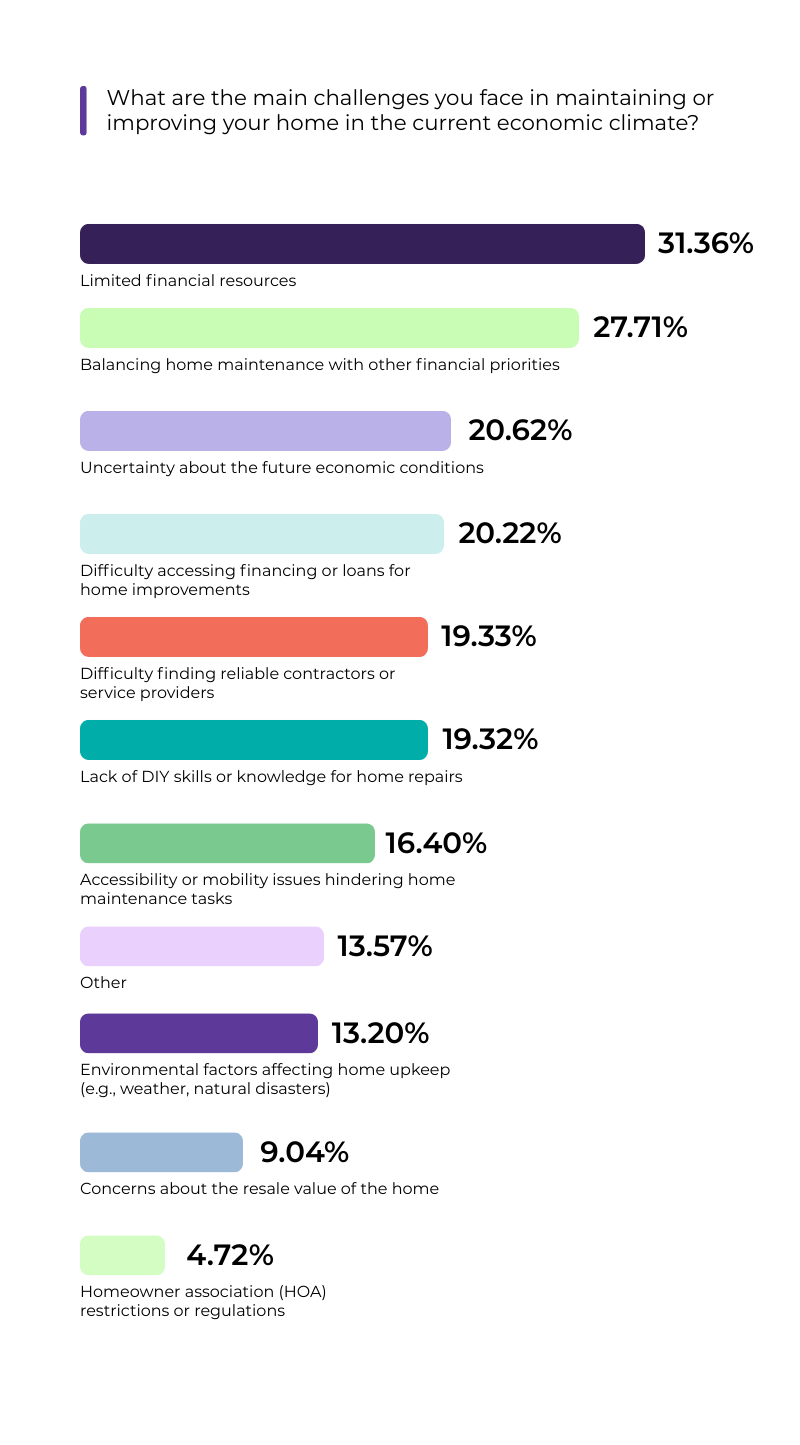

Cost Concerns Are the Biggest Barrier

When asked about the challenges they face in today’s economic climate, 31.36% of homeowners cited limited financial resources, making it the top barrier to moving forward with home projects. Another 27.71% said they struggle to balance home improvements with other financial priorities, while 20.22% specifically called out difficulty accessing home improvement financing or loans.

These findings highlight that for many homeowners, it’s not about desire or urgency, it’s about affordability. Contractors who can help homeowners overcome these financial hurdles are much more likely to secure jobs and build trust.

Most Homeowners Don’t Have a Clear Budget

Surprisingly, nearly 80% of homeowners have not created a budget for their projects. Among those who did, confidence was shaky: only 21% felt very confident their budget would cover the full project. Half (50.27%) were only somewhat confident, while nearly 16% said they were not confident at all.

This uncertainty makes homeowners hesitant to commit, especially for larger or more complex projects. It also means that contractors who can guide them with clear pricing, financing options, and project planning can reduce hesitation and move projects forward.

Homeowners Want and NEED Home Improvement Financing

One of the most striking findings from this year’s data is that homeowners are open to financing, especially when it can make the difference between “someday” and “today.”

-

74% of homeowners said they would consider financing at least part of their project.

-

31.68% would finance up to half of their project costs.

-

Nearly 19% said they would finance the entire project if given the option.

The main hesitation around home improvement financing isn’t interest in the option itself, but rather the terms available. Almost half of homeowners (47.91%) who wouldn’t finance 100% of their project said it was because interest rates are too high, while 13.33% said they didn’t want to take on too much debt. This shows that financing solutions with transparent terms and homeowner-friendly rates could unlock significant opportunities.

What These Homeowner Industry Trends Mean for Home Services Professionals

The message from homeowners is clear: cost and financing are central to decision-making in 2025. Contractors who can ease financial stress by offering practical home improvement financing solutions will not only win more projects but also stand out as trusted partners in today’s challenging economic climate.

That’s why Modernize is proud to offer 360Finance, a solution designed to help contractors offer financing directly to homeowners. With 360Finance, contractors can provide flexible options that make projects more affordable, helping homeowners say “yes” sooner and giving contractors a competitive edge.

If you’re interested in adding financing options for your customers, click here to learn more about 360Finance.