Are you doing a solar project?

Modernize can pair you with three to four pros in your area, so you can compare options and save time and money.

Investing in solar energy for your home is a worthwhile, but significant, investment. As you vet and select the best solar energy contractor for your project, it is important to understand all the factors that affect the overall cost of your solar panels and the return you should expect on your investment. To make sure your project is as cost-conscious as possible, learn about the latest solar energy market and policies ahead of your upcoming solar panel installation.

The 2025 Solar Energy Market

First thing’s first – it’s important to know that in 2025, the solar energy market in the U.S. is thriving. The cost of solar installation has dropped more than 70 percent since 2010, according to data from Solar Energy Industries Association. This is exciting news to anyone looking to invest in residential solar energy.

SEIA found that, as of 2020, prices were at or close to their lowest historical level. It calculates a national average of $20,000 (“before incentives”) for an average-sized residential solar energy system. Compare this to 2010, when the national average was double this – at $40,000 for the average U.S. home.

One major reason for this decrease in price is the booming demand for residential solar energy. SEIA calculates that as of 2018, a new solar energy project was installed every 100 seconds in the U.S.

Solar Energy Soft Costs

But the hardware behind solar panel systems accounts for just about a third (36 percent) of the total price you could pay for the full project. According to 2016 data from the Department of Energy, non-hardware “soft costs” make up as much as 64 percent of the price residents pay for solar energy systems. These costs range from permitting to labor to financing.

“As hardware costs have fallen, soft costs have increased as a share of total system costs,” reported SEIA.

These soft costs vary by contractor. It’s important you understand the structure and source of your contractor’s price. To ensure you avoid solar-related financial surprises down the road, research the long-term solar savings before diving into an installation.

Understanding Solar Energy Policy

Adhering to local policies and taking advantage of local, regional, and federal incentives is key to seeing the highest return on investment from your project. In addition, not doing so could result in applicable fines or fees.

When it comes to powering your home with solar energy, there’s a lot of information to keep track of. The Department of Energy’s Database of State Incentives for Renewables & Efficiency (or DSIRE) lists hundreds and hundreds of policies and incentives across the country, numbering anywhere from West Virginia’s 14 to Oregon’s 147.

According to the Department of Energy itself, “there isn’t a single process or system that businesses follow to get solar customers online.” It points out that in the U.S., there are:

Find the Right Contractor for Your Solar Project

Whether you’re ready to begin your project now or need some expert advice, our network of contractors are here to help. With a few simple questions, we’ll find the best local professionals for you

- 18,000 jurisdictions

- 3,000 utilities

- 50 state systems

Each one of these has its own rules and regulations regarding solar energy, which can “drive up costs and limit solar adoption.”

“As a result, customers experience a lag time between when they buy a solar system and when it actually gets installed,” the DOE reports, adding it’s “a frustrating experience that also adds costs.”

Meet with your contractor in-person to get a proper understanding of how local, state, and federal policy applies to you. Communicate with your contractor regularly for updates to rules and to discuss future needs.

Possible (And Massive) Solar Energy Savings

When it comes to investing in solar energy, you also want to take advantage of existing financial incentives. Your contractor should be able to explain which of these apply to you and how to best make use of them.

Chief among the incentives is the Residential Renewable Energy Tax Credit, which applies to up to 30 percent of your installation (that’s hard and soft costs combined).

For example, SEI reports that a typical five-kilowatt solar system installation in September 2018 would drop from $15,428 to $10,800 after the rebate is applied. While such a discount is tempting, tax incentives apply during tax season—not before. Some contractors agree to take on the full cost during installation and wait for the rebate themselves. Whatever the case, it’s important to have a clear understanding of how this and other incentives will apply to your present and future solar panel system costs.

Understandably, rebates and incentives aren’t just driving consumer interest. Contractors are stepping up their game to compete in an increasingly saturated market. According to SEIA, in fact, that’s one of the drivers behind the rise of those soft costs we mentioned above—contractors are putting more resources than before into connecting with consumers.

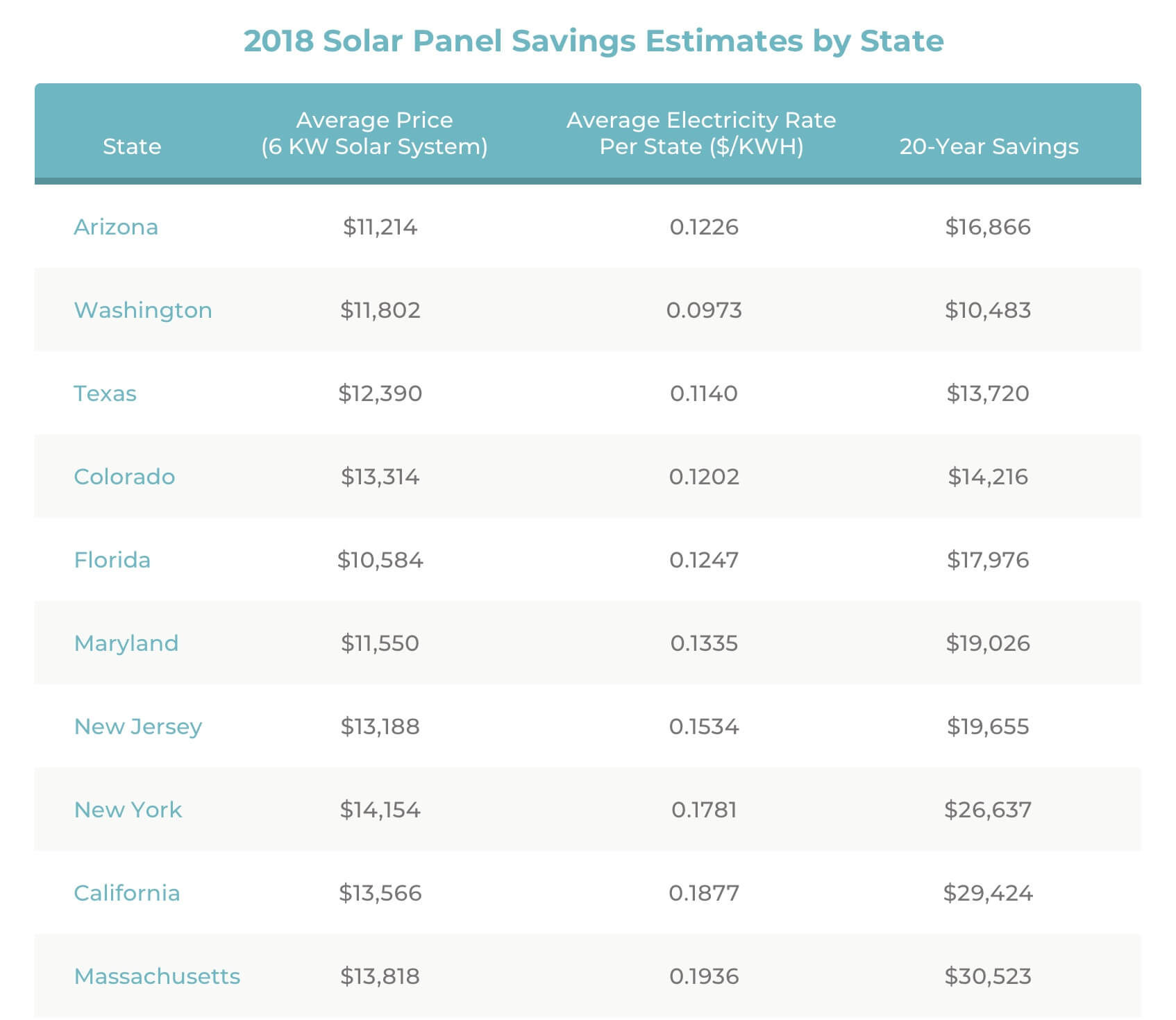

Data based on the following premise:

System size – 6 kilowatts;

Electricity demand – 11,000 kilowatt-hours per year;

Utility rate inflation – 2.2 percent

In a sea of noise, our tools can help you understand solar energy and the installation process. Modernize helps you save the most amount of money in the short term and see the highest return on your investment in the long-term.

Find the Right Contractor for Your Solar Project

Whether you’re ready to begin your project now or need some expert advice, our network of contractors are here to help. With a few simple questions, we’ll find the best local professionals for you

Reviews from Real Homeowners

Welcome to Homeowner Resources! We are the Modernize blog. Modernize pairs more than 3 million homeowners a year with pre-vetted contractors in their area. This blog started because we believe homeowners should know everything about their homes, from how their HVAC works to which front door colors they might love. On Homeowner Resources, you can find information on every part of your home, right down to how you can negotiate with contractors to get the best price. Here's more about the blog.

Need a contractor? Learn more about how Modernize finds the right pro for you.